(MoneyHippo.com) – An essential yet often overlooked aspect of personal finance is tax planning. Taxes can significantly affect net income, savings, and investment decisions, making tax planning an indispensable tool for achieving financial goals. This essay provides an in-depth look into the intricacies of tax planning, its importance, and strategies to optimize tax efficiency.

I. Understanding Tax Planning:

- Definition: Tax planning involves analyzing one’s financial plan from a tax perspective. The purpose is to ensure tax efficiency, with the elements of the financial plan working together to minimize tax liability.

- Importance of Tax Planning: Effective tax planning can help individuals and families maximize income, save for retirement, fund education, and pass wealth to future generations with minimal tax liability.

- Complexity: The complexity of tax planning can vary greatly depending on an individual’s financial situation, income sources, location, and more.

II. Principles of Tax Planning:

- Tax-deferred growth: Investment growth that is not taxed until withdrawal can lead to significant compounding benefits over time. Examples include retirement accounts like 401(k)s and IRAs.

- Tax-efficient investing: Some investments, such as index funds and exchange-traded funds, tend to be more tax-efficient than others due to their low turnover rates.

- Income shifting: This involves shifting income to family members in lower tax brackets to reduce the overall tax burden.

III. Tax Planning Strategies:

- Maximize deductions and credits: Utilize all available deductions and credits to lower your taxable income. Examples include the mortgage interest deduction, education credits, and more.

- Leverage retirement accounts: Fully contribute to retirement accounts to take advantage of tax-deferred or tax-free growth.

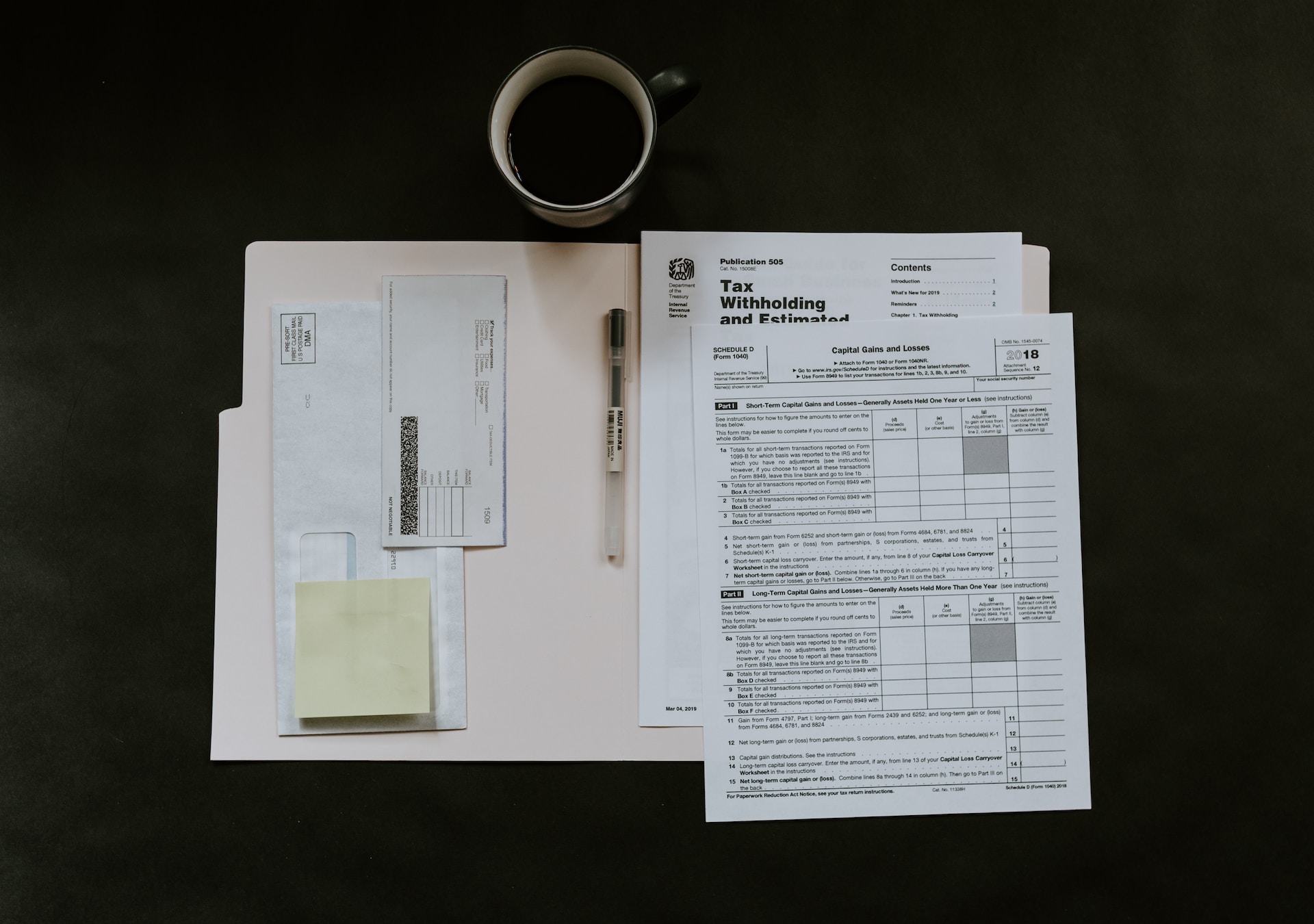

- Manage capital gains and losses: Utilize capital losses to offset capital gains, a strategy known as “tax-loss harvesting”.

IV. Common Tax Planning Mistakes:

- Overlooking deductions and credits: Missing out on deductions and credits can lead to higher taxable income and taxes owed.

- Improper timing of income and deductions: The timing of when income is received and when expenses are paid can significantly impact taxes.

- Not considering the tax implications of investments: Different investments have different tax consequences. It’s important to understand these before investing.

V. The Role of a Tax Planner:

- Expert guidance: A knowledgeable tax planner can provide expert guidance, keep you updated on tax law changes, and help optimize your financial plan for tax efficiency.

- Avoiding mistakes: Tax professionals can help you avoid common mistakes, ensuring all deductions and credits are utilized and all income is reported accurately.

- Planning for the future: They can also help you plan for future tax implications, such as the tax impact of retirement withdrawals or selling assets.

Tax planning plays a vital role in personal finance management, allowing individuals to maximize their income and savings while minimizing their tax liability. By understanding key tax planning principles and employing strategic tax planning techniques, individuals can greatly improve their overall financial health. Moreover, consulting with a professional tax planner can provide further guidance, ensuring a comprehensive and efficient tax strategy is in place.

Copyright 2023, MoneyHippo.com